There are all sorts of great lists of the traditional funding methods and sources for small business, however, where can you find out about the non-traditional funding sources available to raise capital or fund projects and programs, especially two: Grants and Fundraising Activities?

You guessed it … right here … “Access To Free Money Most Small Businesses Don’t Know About!” They are:

*[1] GRANTS.* Many people believe you have to be a non-profit organization (NPO) to get grant money and that grant money somehow doesn’t apply to your Small Business needs and goals. Not true!

| As a funding expert, a grant writer and strategy development consultant, I’ve seen the grants world evolve. I’ve also chosen to enlighten the Small Business community on the newer developments and how to go about pursuing this available source of money. |

With funding sources seeing the advantages of partnering with Small Business in order to further their own missions, access to grants has come available as one of the newer Non-Standard Approaches to funding. It truly is for the heart-centered, purpose-driven business owner whose mission includes more than driving revenue to its’ bottom line. There’s a clear giving component to doing business, whether to your own project or program, or to one you might choose to partner with to effect positive change.

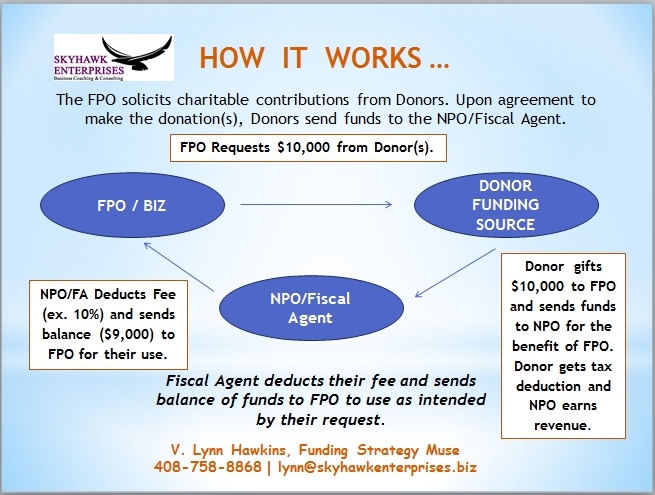

*[2] Traditional and Non-Traditional FUNDRAISING Activities.* Fundraising can happen many ways and with the growing participation in crowdfunding, plus the upcoming change, it allows for easier campaigning across a broader global audience.

| While the days of the fish fry and sale of chicken dinners are not gone, there are a number of things that can be done besides these. I would like to note that these two events have shown record consistent success, although they have also been a lot of work of the hands of a lot of volunteers. | That doesn’t change and that is what makes this type of fundraising so good. There are a few things that can be done by small business to raise money for a cause, whether it’s a large piece of equipment, to raise funds to cover the salary of a new yet needed employee whose addition would dramatically impact company earnings capabilities, a project or program that you want to provide for an underserved population. |

-Establish a training program for employees to learn to eat better, causing healthier employees, reducing a increasing statistics of obesity among the working class … qualifies in the health and wellness category and training

-Writing a book that is coupled with strategies for building viable and sustainable new women-owned businesses, providing a support mechanism to business owners earning less than $xx.xx revenue in the last 12-24 months and who cannot afford to pay for the coaching, consulting and business development help they need. While the SBA and SCORE are available to assist in many ways, a specialized program could qualify in the category of training.

| -Supporting a program, project or a cause that is truly others focused provides another oportunity to bring funds to you. |

http://permissionmovement.org

The bottom line is, when you’ve got a business, program or project and you want to do something that has a farther reaching benefit either to a person (not the business owner), a group of persons, or the business per se’, something that will benefit more people because of what you’re doing, when you can define the what, why, when, and how that happens, you could qualify to apply for grant funding, as well as do traditional and non-traditional fundraising to raise capital.

If you’d like more information about how small business owners can position themselves to pursue grant funding, or design a fundraising strategy that you can implement, send a request to info@skyhawkenterprises.biz

Skyhawk Enterprises and Skyhawk Philanthropic Ventures is on a mission to educate and empower small business owners about innovative funding opportunities, and help design funding strategies that position small business owners to pursuit this type of funding source with more success. We do that through the P3 Academy of Social Entrepreneurship and invite you to come play with us.

V. Lynn Hawkins is a small business strategist and business development expert, co-author of Woman Entrepreneur Extraordinaire, founder of the P3 Academy of Social Entrepreneurship, and host of the weekly BIZ Info Zone WebTV Show hosted in Google Hangouts on Air. Lynn helps women entrepreneurs plan and implement the strategies that build business and bring in more revenue, so they can do more good in the world.

Skyhawk Enterprises | 408-758-8868 | info@skyhawkenterprises.biz

Pingback: lovoo kündigen kreditkarte

Pingback: hydroxychloroquine for covid 19

Pingback: hydroxychloroquine ointment

Pingback: hydroxychloroquine 10 price

Pingback: hydroxychloroquine south dakota study

Pingback: generic ivermectil without a doctor

Pingback: medicine stromectol 6mg

Pingback: dapoxetine 60 mg

Pingback: stromectol for trichuriasis infection

Pingback: stromectol antiparasitic tablet

Pingback: ivermectin side effects

Pingback: buy ivermectin online with examination

Pingback: ivermectin stromectol

Pingback: dosing for ivermectin

Pingback: plaquenil and antimalaria tablets

Pingback: is ivermectin generic

Pingback: ivermectin dosage for crusted scabies

Pingback: will ivermectin kill corona

Pingback: dose of ivermectin for humans

Pingback: how long does ivermectin take to work

Pingback: viagra pills no prescription

Pingback: viagra by pfizer

Pingback: price of prescription drugs

Pingback: cialis buy no prescription

Pingback: hydroxychloroquine for sale on amazon

Pingback: stromectol canada for sale

Pingback: generic tadalafil 20mg canada

Pingback: over the counter viagra in canada